The Single Strategy To Use For Offshore Company Formation

Table of ContentsHow Offshore Company Formation can Save You Time, Stress, and Money.Examine This Report on Offshore Company FormationThe Greatest Guide To Offshore Company FormationOffshore Company Formation for Beginners

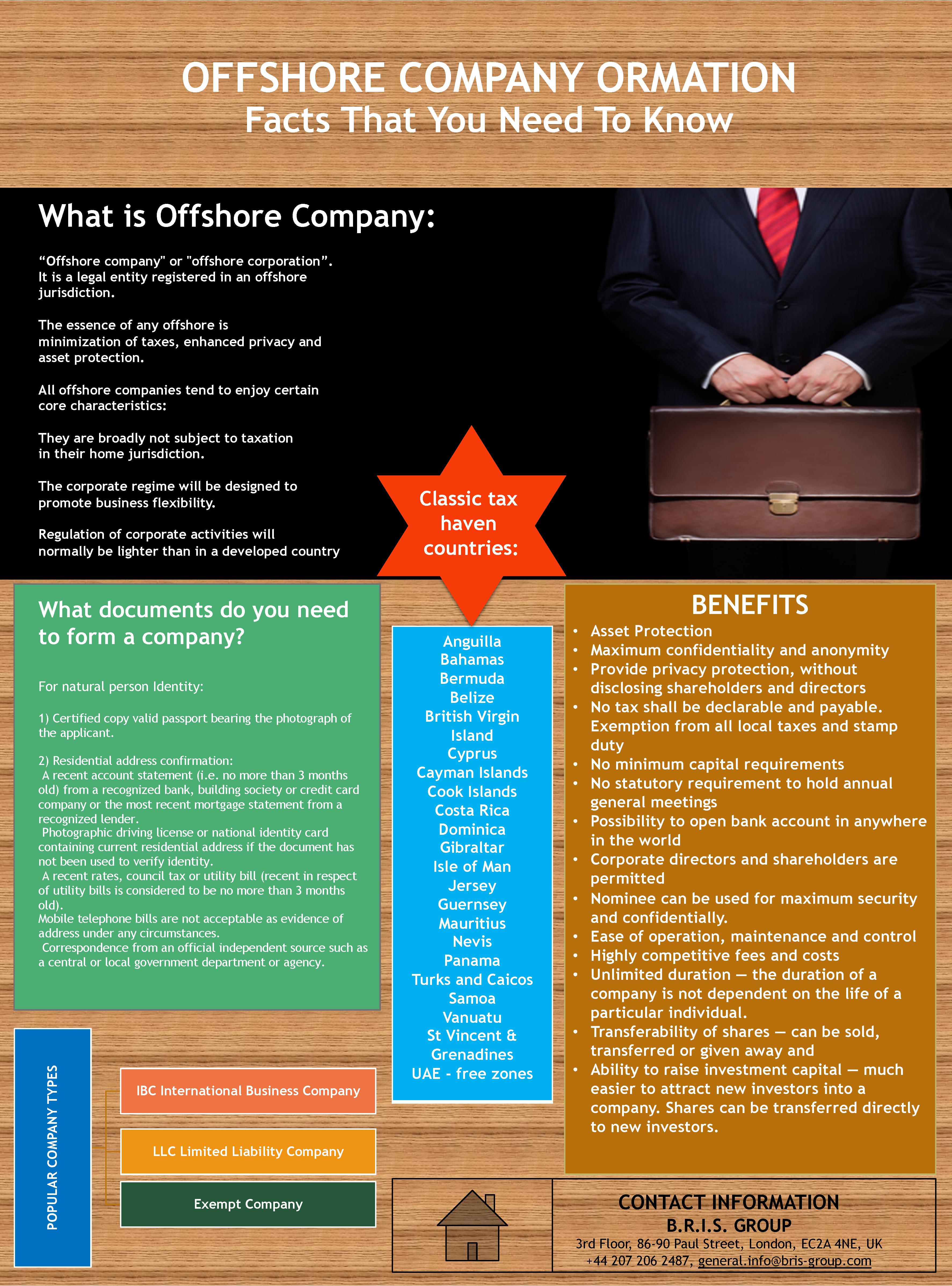

Given all these benefits, an overseas business formation in Dubai is one of the most suitable kind of business if you are seeking to realise purposes and/or tasks such as any one of the following: Supply specialist solutions, consultancy, and/or act as a company Source foreign talent/ expatriate staff Function as a Home Having & Investment firm International trade Restricted insurance coverage Tax exemption Nevertheless, offshore firms in UAE are not permitted to participate in the complying with business tasks: Money Insurance policy as well as Re-insurance Aeronautics Media Branch set-up Any type of company task with onshore business based in UAE Organization Advantages Of A Dubai Offshore Business Development Outright privacy and also personal privacy; no disclosure of investors and accounts needed 100 per cent complete ownership by a foreign nationwide; no local enroller or partner required 100 percent exception from company tax for half a century; this alternative is eco-friendly 100 percent exemption from individual income tax obligation 100 per cent exemption from import and also re-export obligations Protection as well as monitoring of possessions Business operations can be carried out on an international degree No limitations on foreign ability or workers No restrictions on currencies and no exchange policies Office is not called for Capacity to open and also maintain savings account in the UAE and overseas Capacity to invoice regional as well as global customers from UAE Consolidation can be completed in less than a week Investors are not needed to show up prior to authority to assist in unification Vertex Global Professional gives been experts offshore business configuration services to help international entrepreneurs, financiers, and also corporations develop a neighborhood visibility in the UAE.What are the readily available jurisdictions for an offshore company in Dubai as well as the UAE? In Dubai, presently, there is just one offshore territory readily available JAFZA offshore.

Additionally, physical visibility within the nation can likewise assist us obtain all the documentation done without any problems. What is the timeframe required to start an offshore business in the UAE? In a suitable scenario, establishing an offshore firm can take anywhere between 5 to 7 working days. Nevertheless, it is to be noted that the registration for the very same can just be done through a registered representative.

7 Easy Facts About Offshore Company Formation Described

The offshore firm registration procedure must be carried out in complete guidance of a firm like us. The requirement of opting for overseas business enrollment process is needed before establishing up a firm. As it is required to fulfill all the conditions after that one must describe a correct organization.

An is defined as a firm that is included in a territory that is apart from where the helpful owner resides. In various other words, an overseas company is simply a company that is incorporated in a country overseas, in an international territory. An offshore firm meaning, however, is not that simple and also will certainly have differing interpretations relying on the scenarios.

The Best Strategy To Use For Offshore Company Formation

While an "onshore business" refers to a domestic firm that exists as well as operates within the boundaries of a country, an overseas business in comparison is an entity that performs every one of its deals outside the boundaries where it is incorporated. Due to the fact that it is possessed and exists as a non-resident entity, it is not liable to regional official website taxation, as all of its economic deals are made outside the borders of the jurisdiction where it lies.

Firms that are developed in such offshore territories are non-resident since they do not perform any kind of economic deals within their boundaries and why not find out more are possessed by a non-resident. Developing an overseas firm outside the nation of one's own house adds extra protection that is discovered only when a firm is integrated in a different lawful system.

Since overseas firms are acknowledged as a different lawful entity it operates as a separate individual, distinct from its proprietors or directors. This splitting up of powers makes a difference in between the owners and the business. Any type of activities, debts, or obligations tackled by the business are not passed to its directors or members.

The Best Strategy To Use For Offshore Company Formation

While there is no single standard whereby to determine an offshore firm in all offshore jurisdictions, there are a number of attributes and also distinctions special to particular economic centres that are thought about to be overseas centres. As we have claimed because an overseas company is a non-resident as well as performs its deals abroad it is not bound by neighborhood business tax obligations in the country that it is incorporated.

Typical onshore countries such as the UK and also US, usually viewed as onshore economic centers really have overseas or non-resident corporate policies that enable international firms to integrate. These company frameworks likewise have the ability to be cost-free from local tax also though ther are formed in a common high tax onshore setting. offshore company formation.

To find out more on finding the finest nation to develop your overseas firm go below. People and companies choose to develop an offshore business mostly for numerous factors. While there are distinctions in Visit Website between each offshore jurisdictions, they have a tendency to have the adhering to resemblances: Among one of the most engaging reasons to utilize an overseas entity is that when you make use of an offshore business framework it separates you from your business in addition to possessions as well as obligations.